DUBLIN , Nov. 15, 2022 /PRNewswire/ -- The "Servo Motors and Drives Market by System (Linear, Rotary), Communication Type (Fieldbus, Industrial Ethernet, Wireless), Voltage (Low, Medium, High), Brake Technology, Material, Product Type, End-users, Offering and Region - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

The servo motors and drives market size will grow to USD 15.8 Billion by 2027 from USD 12.0 Billion in 2022, at a CAGR of 5.7% during the forecast period. The increase in motion control equipment's required for automation in major industrial sectors is driving servo motors and drives market Mitsubishi Pcb Board

Hardware segment is expected to emerge as the largest segment based on offering for the servo motors and drives market

The servo motors and drives market has been segmented into hardware, software and services. The hardware segment is projected to larger share during the forecast period. This is due to the widespread use of servo motors and drives components, which together constitute the hardware segment. The major reasons behind the growing demand for servo motors and drives include the rapid growth and advancements in industrial automation. Setting up automation requires servo motors and drives, which offer a high level of precision, accuracy, and torque with low maintenance costs

Servo Drives segment is expected to be the fastest growing segment of the servo motors and drives market, by product type

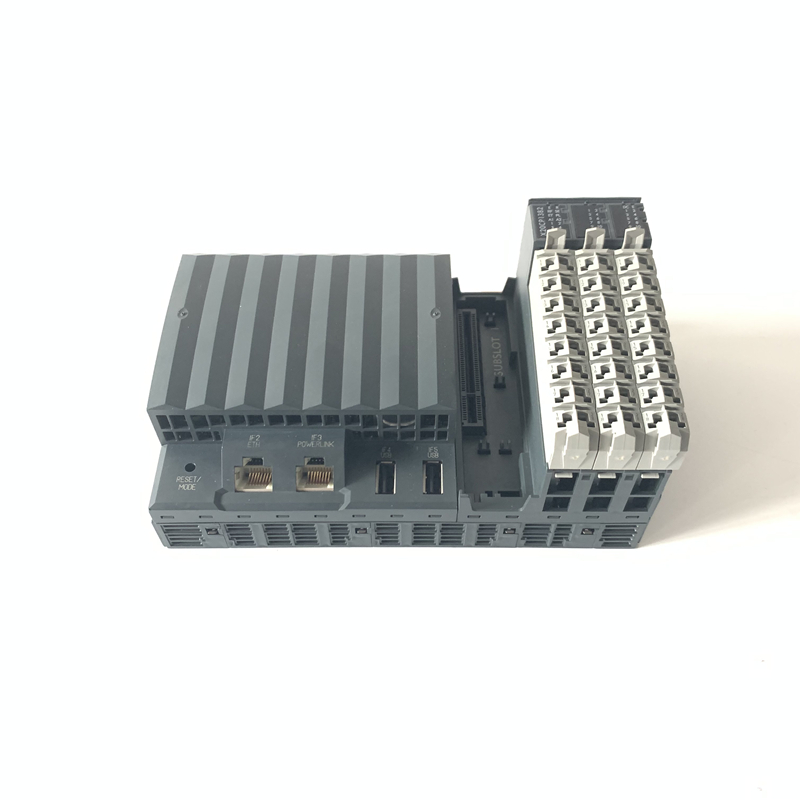

Based on product type the servo motors and drives market is segmented into servo motors and servo drives. Servo drives have observed high demand since the last few years, driven by advancements in servo systems, which has facilitated easy customization. Advancements, in turn, have led to increased use of servo drives in industrial control systems, warehouse automation, and robotics.

Asia Pacific is expected to be the largest market during the forecast period.

The Asia Pacific is expected to be the largest growing market in the servo motors and drives market. The growth of the market in Asia Pacific can be attributed to the flourishing electronics market in India , China , Taiwan , and Japan . These countries are the leading markets for consumer electronics, such as smartphones, home appliances, kitchen appliances, smart home devices, remote control solutions, wearable devices, and other battery-operated electronic products.

The growth of the servo motors and drives market in Asia Pacific can also be attributed to its booming automotive manufacturing sector. The sector has witnessed rapid changes in terms of manufacturing technologies to enhance automotive production and manufacturing facilities. These changes are projected to catalyze the adoption of servo motors and drives in the Asia Pacific region.

5 Market Overview 5.1 Introduction 5.2 Market Dynamics 5.2.1 Drivers 5.2.1.1 Rising Need for Motion Control Systems in Automated Production Plants 5.2.1.2 Increasing Adoption of Servo Motors Due to Better Features Compared with Stepper Motors 5.2.2 Restraints 5.2.2.1 High Investment Involved in Integrating New Automation Technologies into Current Infrastructure 5.2.2.2 Lower Cost of Other Motion Control Motors Compared with Servo Motors 5.2.3 Opportunities 5.2.3.1 Need for Feedback Control in Servo Systems Driving Demand for Encoders 5.2.3.2 Growth in Adoption of Smart Manufacturing Initiatives in Industries 5.2.4 Challenges 5.2.4.1 Supply-Chain Disruptions in Steel Industry 5.2.4.2 Shortage of Skilled Workforce to Handle Complexities in Automated Manufacturing Facilities 5.3 Trends/Disruptions Impacting Customers' Businesses 5.3.1 Revenue Shift and New Revenue Pockets 5.4 Value Chain Analysis 5.4.1 Raw Material Providers/Suppliers 5.4.2 Component Manufacturers 5.4.3 Manufacturers/Assemblers 5.4.4 End-Users 5.4.5 Post-Sales Service Providers 5.5 Market Map 5.6 Average Selling Price Trend 5.7 Technology Analysis 5.8 Trade Analysis 5.9 Tariff and Regulatory Landscape 5.10 Porter's Five Forces Analysis 5.11 Key Stakeholders and Buying Criteria 5.12 Innovations and Registered Patents 5.13 Case Study Analysis 5.13.1 Motion Control Motors and Drives Designed with Cutting-Edge Technology Accelerate Bottle Labeling 5.13.2 Troubleshooting Motion Control System Using Moog Animatics Smart Motor Data 5.14 Key Conferences and Events, 2022-2023

6 Servo Motors and Drives Market, by Offering 6.1 Introduction 6.2 Hardware 6.2.1 Sensors 6.2.1.1 Adoption of Mems-Based Sensors to Boost Market Growth 6.2.2 Controller Modules 6.2.2.1 Controller Modules Improve Efficiency of Servo Motors by Tracking Commanded Inputs and Blocking Errors 6.2.3 Encoders 6.2.3.1 Increasing Demand for Industrial Robots to Boost Adoption of High-Resolution Rotary Encoders 6.2.4 Electronic Amplifiers 6.2.4.1 Development of Enhancement-Mode Gan Field-Effect Transistor-Based Class D Amplifiers to Boost Use of Electronic Amplifiers 6.2.5 Other Components 6.3 Software and Services 6.3.1 Servo Software Automate Various Tasks Involved in Running and Monitoring Connected Field Devices

7 Servo Motors and Drives Market, by Product Type 7.1 Introduction 7.2 Servo Motors 7.2.1 Rising Demand for Closed-Loop Control to Improve Reliability of Industrial Processes 7.3 Servo Drives 7.3.1 Growing Need for Servo Drives to Control Servo Motors

8 Servo Motors and Drives Market, by Voltage 8.1 Introduction 8.2 Low Voltage (Below 400 V) 8.2.1 Ease of Operation and Low Setup & Maintenance Costs to Drive Market 8.3 Medium Voltage (Between 400 V and 690 V) 8.3.1 Medium-Voltage Servo Drives Offer Benefits Such as Economies of Scale and High Reliability 8.4 High Voltage (Above 690 V) 8.4.1 High-Voltage Servo Drives Offer Programmable Settings That Lead to Improved Quality Assurance

9 Servo Motors and Drives Market, by System Type 9.1 Introduction 9.2 Linear Systems 9.2.1 Direct-Drive Linear Servo Motors Offer Benefits Such as Improved Throughput and Better Precision 9.3 Rotary Systems 9.3.1 Need to Improve Productivity of Processes in Various Industries to Drive Penetration

10 Servo Motors and Drives Market, by Brake Technology 10.1 Introduction 10.2 Spring 10.2.1 Spring Brakes Are Mainly Used in Robotics, Elevators, and Lifting Machines 10.3 Permanent Magnet 10.3.1 Permanent Magnet Brakes Ideal for Robots and Handling Equipment 10.4 Others

11 Servo Motors and Drives Market, by Material of Construction 11.1 Introduction 11.2 Stainless Steel 11.2.1 Ability of Stainless Steel to Handle Harsh Environments to Drive Demand 11.3 Others

12 Servo Motors and Drives Market, by Communication Type 12.1 Introduction 12.2 FieldbUS 12.2.1 Reduction of Cable Installations for Communication to Drive Demand 12.3 Industrial Ethernet 12.3.1 Features Such as High-Speed Transmission to Drive Demand 12.4 Wireless 12.4.1 Reliable Communication Technologies Such as Wlan and Bluetooth to Drive Market

13 Servo Motors and Drives Market, by End-User 13.1 Introduction 13.2 Automotive & Transportation 13.2.1 New Technologies in Mobility to Drive Demand 13.3 Semiconductor & Electronics 13.3.1 Servo Motors Facilitate Semiconductor Manufacturing Processes 13.4 Food Processing 13.4.1 High-Precision Requirements in Food Processing Industry to Create Demand 13.5 Textile 13.5.1 High-Quality Production Offered by Servo Motors to Accelerate Demand 13.6 Petrochemical 13.6.1 Ability of Servo Motors to Work in Harsh Environments to Drive Market 13.7 Pharmaceutical & Healthcare 13.7.1 Requirement of Servo Motors for Proper Handling of Production Processes to Drive Market 13.8 Packaging 13.8.1 Need for Speed, Precision, and Reliability in Packaging Applications to Drive Market 13.9 Printing & Paper 13.9.1 Flexibility in Printing Operations to Boost Demand 13.10 Others

15 Competitive Landscape 15.1 Strategies Adopted by Key Players 15.2 Market Share Analysis of Top Five Players, 2021 15.3 Five-Year Company Revenue Analysis 15.4 Company Evaluation Matrix/Quadrant 15.4.1 Stars 15.4.2 Pervasive Players 15.4.3 Emerging Leaders 15.4.4 Participants 15.5 Startup/Sme Evaluation Quadrant 15.5.1 Progressive Companies 15.5.2 Responsive Companies 15.5.3 Dynamic Companies 15.5.4 Starting Blocks 15.6 Competitive Benchmarking 15.7 Servo Motors and Drives Market: Company Footprint 15.8 Competitive Scenario

16 Company Profiles 16.1 Yaskawa Electric 16.2 Mitsubishi Electric 16.3 Siemens 16.4 Schneider Electric 16.5 Rockwell Automation 16.6 Abb 16.7 Nidec 16.8 Delta Electronics 16.9 Fanuc 16.10 Fuji Electric 16.11 Kollmorgen 16.12 Parker Hannifin Corporation 16.13 Omron Corporation (Omron) 16.14 Sew Eurodrive 16.15 Lenze 16.16 Bosch Rexroth 16.17 Weg 16.18 Ametek 16.19 Rozum Robotics 16.2 Adtech (Shenzhen ) Technology Co. Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/dvyqs1

Research and Markets Laura Wood , Senior Manager press@researchandmarkets.com

For E.S.T Office Hours Call +1-917-300-0470 For U.S./CAN Toll Free Call +1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

U.S. Fax: 646-607-1904 Fax (outside U.S.): +353-1-481-1716

Logo: https://mma.prnewswire.com/media/539438/Research_and_Markets_Logo.jpg

Plc Analog Output View original content:https://www.prnewswire.com/news-releases/the-worldwide-servo-motors-and-drives-industry-is-expected-to-reach-15-8-billion-by-2027--301678737.html